Fraud tactics are evolving faster than ever, and they’re becoming increasingly sophisticated. Driven by AI, automation, and novel attack vectors like synthetic identities and phishing-based account takeovers, organizations today face threats that can slip past outdated, rule-based defenses. To keep pace, fraud teams need advanced tools that combine real-time monitoring, machine learning, and contextual intelligence.

We’ve identified the best fraud detection software platforms and tools for different use cases, including:

In this guide, we’ve rounded up 21 of the top fraud detection software tools available in 2026, from AI-powered engines that monitor payments in real time to document forensics tools that spot synthetic onboarding attempts. We’ve also included identity resolution platforms like Horizon® Identity that give investigators the tools to uncover who’s really behind fraudulent activity.

To create this guide, we reviewed leading fraud detection platforms based on their core features, detection capabilities, and adaptability to evolving fraud tactics. We also considered integration options with existing security stacks, scalability for high-volume environments, and explainability of results, all critical for fraud teams under pressure to act quickly.

In addition, we factored in customer feedback and analyst recognition. We’ve broken down the unique strengths and capabilities of each tool, helping organizations choose the right mix of solutions to stay ahead of evolving fraud tactics.

What are fraud detection software tools?

Fraud detection software tools are solutions built to detect patterns, anomalies, and behaviors that signal fraud before it can cause significant harm. These tools analyze data from multiple sources, such as transactions, customer accounts, devices, networks, and open-source intelligence (OSINT) to identify suspicious activity. Given the sheer volume of data points that these tools manage, they’re able to pinpoint potential fraud indicators that would be possible for humans to detect at scale.

Instead of simple rule-based systems that may flag potential issues like a large withdrawal or mismatched IP address, today’s fraud detection software tools leverage machine learning, statistical models, and risk scoring to adapt as criminals’ tactics evolve. These tools monitor systems and data sources in real-time to flag potential fraud indicators, such as:

-

- Synthetic identities – fake identities that combine real and fabricated information to create the appearance of a legitimate individual

-

- Mule accounts – bank or payment accounts that fraudsters use to move, hide, or cash out stolen or illicit funds

-

- Phishing-driven account takeover (ATO) – when attackers use phishing tactics to steal login credentials and then use those credentials to seize control of a victim’s account

-

- Payment fraud – unauthorized or deceptive transactions in which a criminal tricks a business, financial institution, or individual into losing money during a payment process

Fraud detection software tools can identify potential fraud indicators early, often before criminals act. This enables security professionals and investigators to intervene quickly, preventing fraud from escalating into financial losses, regulatory violations, or long-term reputational damage.

The growing importance of fraud detection

Fraud tactics and techniques are evolving quickly with the same AI and automation that businesses use to scale operations. Deepfake identities, AI-assisted phishing, and faster cross-border payment rails have raised the stakes. Without software capable of adapting in real time, organizations risk falling behind attackers who continuously test and refine their methods.

Open-source intelligence (OSINT) plays a growing role in fraud detection. Public data, such as usernames, breached credentials, and social media activity, often reveals the footprint of fraud long before it hits a payment system or claims platform.

When fraud detection software can draw on OSINT sources as well as direct data from an organization, it can begin to see more than just transactions. It starts to understand the wider digital landscape, connections, networks and patterns. That extra layer of context can go a long way towards preventing synthetic identities and burner accounts from remaining under the radar.

What to look for in fraud detection software tools

For most organizations, a fraud detection software platform is part of a broader defense strategy. The best platforms combine speed, accuracy, and context, giving investigators the confidence to act without being buried in noise. Here are the factors that matter most:

Real-time monitoring

Fraud moves fast. A tool should flag suspicious activity as it happens, not hours later when the damage is done.

Low false positives

Alerts are only useful if they’re reliable. Good fraud detection software balances sensitivity with precision so teams aren’t overwhelmed by noise.

Adaptability

Criminal tactics evolve constantly. Look for systems that use machine learning or flexible rules engines so detection improves over time.

Data coverage

Fraud detection software should ingest transaction data while connecting with customer records, device fingerprints, geolocation signals, and OSINT sources to build a complete picture.

Explainability

Investigators need to know why an alert was triggered. Transparent scoring and context around decisions cut investigation time and reduce mistakes.

Integration

A tool should fit into your existing technology stack. Case management, SIEMs, and threat intelligence platforms work best when they’re connected.

Scalability

As transaction volumes and data sources grow, the system should handle the load without slowing down or sacrificing accuracy.

The best fraud detection platforms enable organizations to catch threats efficiently, with context, and at scale. By focusing on real-time monitoring, accuracy, adaptability, and integration, organizations can deploy systems that keep pace with evolving fraud tactics while reducing the burden on investigators. The right choice becomes a force multiplier, turning raw data into actionable insight and helping teams stop fraud before it spreads.

The best fraud detection software platforms

Let’s take a look at the best fraud detection software platforms for advanced risk management, including leading tools for identity attribution, real-time transaction monitoring, behavioral biometrics, and fraud prevention.

Fraud Detection Software Comparisons (Top 10)

Before we dive into the full list, here’s a quick comparison chart that shows the best use cases, pricing and key features for 10 of the best fraud detection tools.

| Tool | Best For / Use Case | Pricing | Key Features |

| ShadowDragon (Horizon® Identity) | Attribution and Identity Resolution | Commercial |

|

| LexisNexis® ThreatMetrix® | Real-Time Identity and Device Risk | Commercial |

|

| Kount | E-commerce and Payment Fraud | Commercial |

|

| Feedzai | Banking and Financial Crime (RiskOps) | Commercial |

|

| BioCatch | Behavioral Biometrics (ATO Defense) | Commercial |

|

| FICO® Falcon® Fraud Manager | Card and Payment Transaction Fraud | Commercial |

|

| Sardine | Crypto, Fintech and Lifecycle Fraud | Commercial |

|

| ComplyAdvantage | AML and Transaction Screening | Commercial |

|

| Resistant AI | Document and Synthetic Fraud | Commercial |

|

| ARIC™ Risk Hub (Featurespace) | Adaptive Behavioral Analytics | Commercial |

|

Now let’s do a deep dive into the best software platforms for fraud detection and prevention, leading off with our top pick.

Horizon® Identity: Best for fraud attribution and identity resolution

Horizon® Identity is not a fraud detection engine or a traditional threat intelligence platform; it’s the tool investigators turn to when they need to go beyond alerts and transactions to uncover who’s really behind the fraud. Fraud detection software platforms and case management systems often surface suspicious identifiers, but Horizon® Identity takes those fragments further by resolving them into clear, human-linked digital profiles.

With a single input, such as an email, phone number, or username, Horizon® Identity automatically correlates across more than 550 public sources, over 1,500 endpoints, and more than 15 billion breach records. It reveals aliases, online personas, social activity, and geolocation hints, collapsing synthetic or fragmented identities into one coherent fingerprint.

In fraud and financial crime, attackers often hide behind disposable accounts and mismatched identifiers. Horizon® Identity helps investigators sift through that noise to establish attribution, linking infrastructure back to real-world operators. By cutting research from hours to minutes, it equips fraud teams, claims investigators, and compliance officers with actionable identity intelligence that goes deeper than traditional fraud detection software.

Once you’ve built an identity, you can run deeper link analysis via SocialNet or switch to real‑time monitoring with Horizon® Monitor. This goes beyond static data, giving you context, patterns, and alerting on fraudulent behavior.

Key features:

-

- Instantly resolves identifiers into comprehensive identity profiles using a single search input

-

- Searches across 550+ public sources, 1,500+ endpoints, and 15+ billion breach records

-

- Surfaces linked aliases, usernames, emails, phone numbers, IPs, and social activity while filtering noise

-

- Expands profiles dynamically as new connections are uncovered, enabling deeper pivots with minimal effort

-

- Designed for investigators of all skill levels with a simple, search-bar-driven interface

-

- Integrates seamlessly with Horizon® Monitor and SocialNet to extend investigations into monitoring and link analysis

-

- Generates export-ready profiles and timelines for fraud investigations, case files, or compliance reporting

LexisNexis® ThreatMetrix®: Best for real-time identity and device risk analytics

LexisNexis® ThreatMetrix® detects fraud with high accuracy using a wealth of real-time data, combined with artificial intelligence-driven models and risk engines. It leverages the power of the LexisNexis Digital Identity Network®, a contributory network that unifies digital identity and identity intelligence from thousands of global organizations.That means when someone interacts with an organization’s system, ThreatMetrix® can assess risk based on shared intelligence and real-time feedback from a massive ecosystem.

ThreatMetrix® is backed by machine learning that is trained on billions of proprietary data points and continuously enhanced by real-time feedback loops from thousands of clients for sharper, more adaptive risk decisions.

Deployable in less than a day, the solution provides a no-code, self-service environment where you layer AI-based scoring with your own rules. It’s also customizable, so organizations can fine-tune how they want to respond to threats and adjust policies as fraud vectors evolve.

Its SmartID® device fingerprinting and behavioral biometrics technology help spot device spoofing, malware, unusual device attributes, jailbreak/rooted devices, and app manipulation taking place in the background. This extends across mobile, web, and even healthcare channels, enabling identity verification without disrupting the user experience, which is ideal when sensitive data or high-risk transactions are involved.

Key features:

-

- Taps into the LexisNexis Digital Identity Network® spanning 200+ countries and industries to inform real-time fraud decisions

-

- Processes 200+ data points per transaction, deriving 1,000+ properties within milliseconds for precise risk scoring

-

- Combines device fingerprinting (SmartID®), behavioral analytics, IP/location data, and digital identity signals into a unified risk profile

-

- Supports explainability based on SHAP (SHapley Additive exPlanations) values, giving investigators clear insight into each decision

-

- Offers built-in case management, reporting, and workflow orchestration for end-to-end fraud response

-

- Detects account takeover, mule networks, scams, bots, synthetic/stolen identities, and transaction anomalies across channels

-

- Delivers sub-100ms real-time scoring for both inbound and outbound payments, including protection against APP scams

Kount: Best for AI-driven payment and loyalty fraud prevention

Kount leverages decades of global data from both physical and digital interactions to frame intelligent fraud decisions. With its Equifax backing, the platform applies advanced machine learning frameworks (both supervised and unsupervised) to sift through billions of interactions and detect subtle threats like synthetic identities, account takeovers, card‑testing, and promotions abuse.

It frames that intelligence around user behavior and trust signals, collecting hundreds of data points at every interaction, from email, IP, and device ID to spending patterns and watchlist status. It tailors risk assessments in real time, without blocking true customers or slowing down the experience.

Companies define their business policies, such as how to handle high-risk behaviors and when to decline, review, or approve, and Kount’s AI engines enforce them. For specialized threats like chargebacks, authorized push payment (APP) fraud, or refund abuse, Kount includes pre-configured workflows that reduce manual effort while improving accuracy.

Key features:

-

- Applies dual-mode machine learning (supervised and unsupervised) to detect both known fraud patterns and emerging threats

-

- Delivers instant, high-fidelity risk scores by analyzing hundreds of signals such as device ID, IP, email, and behavioral patterns

-

- Adapts automatically to new fraud tactics while letting teams refine rules and business policies with minimal effort

-

- Provides built-in chargeback protection, friendly fraud management, and dispute recovery tools to safeguard revenue

-

- Detects account takeover attempts through continuous monitoring of logins, velocity patterns, and abnormal device behavior

-

- Equips fraud teams with real-time dashboards, transparent decision logic, and case management tools for streamlined investigations

-

- Integrates seamlessly with major platforms like Shopify, Magento, and Salesforce, backed by expert support and managed services

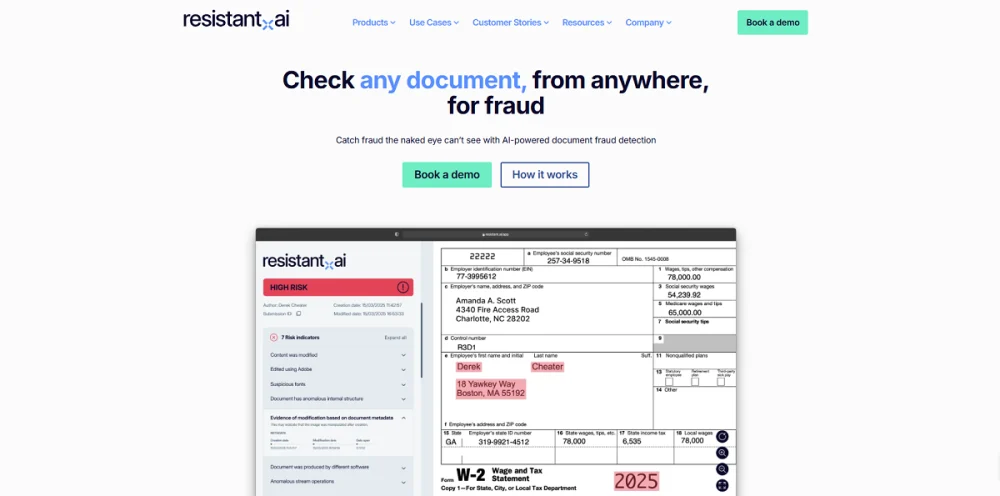

Resistant AI: Best for document and synthetic onboarding fraud detection

Resistant AI is built to protect financial automation systems from manipulation, from the moment documents enter your onboarding flow to behaviors across transactions and ongoing monitoring. Its capabilities span across Document Forensics, Transaction Forensics, and Identity Forensics, creating a 360-degree view of risk across the customer lifecycle.

Document Forensics inspects PDFs and image files (bank statements, pay stubs, IDs, invoices, etc.) for signs of forgery using more than 500 analysis vectors, including metadata, image consistency, fonts, and structural anomalies. It also compares documents across users to flag reuse or template-based mass fraud attempts. The platform returns clear verdicts, such as “High Risk,” “Warning,” or “Trusted,” plus human-readable reasoning for each finding.

Transaction Forensics layers AI onto existing monitoring systems. It replaces noise-heavy rule sets with modular, ready-made model ensembles that detect behavioral anomalies, identity clusters, and novel fraud patterns.

When combined, these tools feed into Identity Forensics, which links document findings, transaction anomalies, and behavior data into a comprehensive, real-time customer profile. This layered logic supports both onboarding fraud prevention and persistent Know Your Customer (KYC) processes, enabling organizations to spot sleep mule setups and fraud rings before they activate.

Key features:

-

- Analyzes financial documents such as bank statements, invoices, and IDs for signs of forgery using 500+ forensic checks

-

- Flags reused or tampered documents across multiple applications to uncover mass fraud attempts

-

- Enhances transaction monitoring with AI-driven model ensembles that reduce false positives and detect novel fraud patterns

-

- Delivers real-time evaluations in under 50 milliseconds, supporting high-volume financial environments

-

- Links document, transaction, and behavioral data into unified identity profiles for ongoing monitoring

-

- Supports persistent KYC by detecting mule accounts, synthetic identities, and fraud rings before activation

-

- Provides explainable results with clear verdicts and reasoning, improving analyst decision-making

Sardine: Best for lifecycle fraud, AML, and compliance in fintech

Sardine is an AI-based fraud and compliance platform, integrating behavioral biometrics and device intelligence to monitor risk across the customer lifecycle, from account creation through payments and account activity. It profiles user interactions in real time, watching for indicators like unusual mouse movement, VPN usage, copy-paste behavior in long-form fields, or rapid field input to flag atypical behavior.

A key component is their proprietary Device Intelligence & Behavior (DIBB) signals, layered with enriched data from more than 40 external providers, including phone, email, SSN, geolocation, credit, and banking sources. This creates a feature library of over 4,800 risk attributes that can be applied in Sardine’s models or an organization’s own models.

This fraud detection software is powered by a real-time risk engine that evaluates sessions using both machine learning and rules-based logic tuned per event type (like onboarding, login, or checkout). It targets various types of fraud, such as bots, scams, account takeover, chargebacks, money muling, and Anti-Money Laundering (AML) risks, often surfacing fraud before transactions complete.

Key features:

-

- Detects a wide range of fraud types, from synthetic identities and money mules to ATO, scams, card fraud, and AML risks

-

- Combines device intelligence with behavioral biometrics to analyze interactions in real time and spot anomalies early

-

- Operates on a modular, API-first platform, covering everything from onboarding fraud and KYC/AML to payment protection and case management

-

- Supports prebuilt rule sets, customizable rules, and real-time scoring, enabling deployment in fintech, crypto, and traditional finance quickly

-

- Offers networked intelligence via Sonar consortium, enabling real-time cross-industry signal sharing and risk context

Other fraud detection software tools to consider

ARIC™ Risk Hub

ARIC™ Risk Hub, built by Featurespace and integrated into Visa’s ecosystem, uses Adaptive Behavioral Analytics (ABA) to develop individualized behavioral profiles. It learns in real time what ‘normal’ looks like for each user across payments, logins, and applications, and instantly flags anomalies the moment they happen.

Each profile evolves as customer behavior changes. The models self-adjust based on outcomes, keeping detection accurate without constant manual retraining. This reduces false positives while maintaining strong approval rates for legitimate activity.

To further enhance detection during high-volume events or complex fraud attempts, Featurespace also introduced Automated Deep Behavioral Networks (ADBNs). These deep learning models are designed to spot subtle patterns in evolving fraud threats like account takeover, payment abuse, and sophisticated scams without slowing down performance.

Key features:

-

- Leverages Adaptive Behavioral Analytics (ABA) to learn individual behavior in real time across channels

-

- Identifies anomalies instantly without relying on static rules to catch subtle deviations as they happen

-

- Generates explainable risk decisions, giving fraud teams clarity on why a flag was raised and enabling smarter, defensible actions

-

- Automates risk workflows and can deliver in-channel alerts like “effective warning” messages, helping interrupt scams before they progress

-

- Offers a unified platform configurable via UI and mature integration points for data in, data out, and authentication

BioCatch

BioCatch fraud detection software relies on behavioral biometrics, building detailed user profiles from the way people interact with their devices, including mouse movements, typing cadence, swiping patterns, and moments of hesitation. These interactions reveal both physical and cognitive behavior patterns. By analyzing over 2,000 behavioral parameters per session, BioCatch establishes what “normal” behavior looks like for each user, then flags deviations in real time.

On top of scoring risk based on behavior, BioCatch supplements fraud operations with predictive intelligence and investigation tools. Platforms like BioCatch Scout visualize fraud networks via link analysis, while Analyst Station offers session-level video reconstruction and interactive querying.

The Rule Manager lets you shape policy and simulate outcomes before going live, and the Insights Query Engine integrates with tools like Snowflake for structured data analysis.

Key features:

-

- Continuously profiles users using 2,000+ behavioral parameters (mouse movements, typing cadence, hand-eye coordination, navigation patterns, etc.) without disrupting user experience

-

- Detects fraud across key scenarios, including account opening, account takeover, mule accounts, and social engineering scams, using behavior-based indicators

-

- Monitors user sessions from login to logout in real time, allowing for continuous risk evaluation and early intervention

-

- Identifies sophisticated fraud methods such as Remote Access Trojans (RATs), bots, malware, and social engineering tactics that typical controls may not catch

-

- Includes tools for operations and visibility: Rule Manager (build and simulate fraud rules), Analyst Station (visual investigations), and Predictive Intelligence with Rule Simulator (test rules before deployment)

-

- Offers API-based real-time alerts, enabling immediate when risk thresholds are breached

ComplyAdvantage

ComplyAdvantage offers an AI-driven fraud detection software solution tailored to catch a broad spectrum of payment fraud scenarios. Currently, it tracks over 50 distinct types, including ATO, APP, synthetic identity, relationship fraud, romance scams, invoice fraud, and more. It’s built to monitor both monetary and non-financial events, enabling alerts not only during transactions but also during logins, profile changes, and other user behavior triggers.

ComplyAdvantage leverages machine learning models with dynamic thresholds that auto-adjust based on crime trends, so the system keeps pace with evolving fraud tactics. It supports explainability, offering clear reasons for each alert (e.g., “transaction occurred after failed password attempt” or “time/geolocation mismatch”) to speed up resolution.

Beyond behavior detection, the platform uses identity clustering to connect accounts controlled by the same actor and graph network analysis to trace malicious fund flows within systems. Alerts are fed into a case management system, letting teams categorize risk levels (High, Medium, Low), manage cases with automation, track workflows, and generate dashboard insights for performance monitoring. Analysts get the full context to triage efficiently, supported by flexible data ingestion and unified alert visibility.

Key features:

-

- Detects 50+ fraud types, including ATO, APP scams, synthetic IDs, and mule activity

-

- Adapts automatically with machine learning models that update as fraud patterns evolve

-

- Provides clear, explainable alerts to speed investigations and reduce false positives

-

- Links related accounts through identity clustering and maps fund flows with network analysis

-

- Monitors both transactions and non-financial events like logins or profile changes

-

- Delivers built-in case management with prioritized alerts, dashboards, and workflow tools

Feedzai

Feedzai is an AI-based fraud detection platform designed for banks, payment providers, and fintechs to manage risk across the customer lifecycle. It profiles user behavior continuously, establishing baselines for normal activity and flagging anomalies in real time across account opening, transactions, and ongoing account use. This allows organizations to identify fraud patterns as they emerge, rather than relying only on static rules.

The system incorporates Feedzai IQ, which produces a dynamic “TrustScore” to represent risk on a per-event basis. This scoring is informed by behavioral patterns, device intelligence, and network-wide signals, enabling real-time decisions that balance fraud detection with minimizing false positives.

Feedzai’s architecture is built for scale, supporting high-volume financial environments such as card payments, instant transfers, and mobile banking. Its RiskOps framework brings together data ingestion, transaction scoring, and alert management into a single platform. Alerts are designed with contextual explanations, so investigators can understand why a case was flagged and act more quickly.

Key features:

-

- Generates real-time TrustScores using AI models to detect anomalies across transactions

-

- Builds individual behavioral profiles combining device, transaction, and biometric data

-

- Operates in real time across payments, onboarding, transfers, and scam detection

-

- Provides explainable alerts with context to streamline investigations

-

- Monitors inbound and outbound flows to flag scams, mule activity, and ATO attempts

-

- Scales to enterprise environments, securing billions of events and trillions in payments annually

FICO® Falcon® Fraud Manager

FICO® Falcon® Fraud Manager synthesizes intelligence from billions of payment-card transactions, applying proprietary neural-network analytics to spot fraud in microseconds, without flagging genuine customers in error. It links directly with an organization’s authorization systems to halt suspicious activity instantly at the point of sale.

The platform embeds global consortium models (crowdsourced patterns drawn from thousands of issuers) that sharpen detection accuracy across regions, portfolios, ATMs, merchants, and geographies. Adaptive analytics continually refine detection based on a business’s case outcomes.

Falcon’s system blends analytic scoring with a robust rules management engine (via FICO Blaze Advisor), complete with rule simulation, rapid testing, and deployment. Its case management interface arms analysts with clean tools to investigate, triage, and resolve flagged cases efficiently. Scoring, rules, and cases are all centralized, enabling users to manage enterprise-wide fraud from a single platform.

Key features:

-

- Leverages billions of card transactions and trusted neural network models to detect fraud with high precision and minimal false positives

-

- Real-time scoring directly integrated with authorization systems, providing split-second decisions at the point of sale

-

- Draws on global consortium models and regional intelligence, adapting to both widespread and portfolio-specific fraud patterns

-

- Rules management engine enables users to craft, simulate, and deploy rules with precision

-

- Supports efficient investigations with embedded case management and reporting

FraudNet

FraudNet delivers a full-spectrum, enterprise-grade fraud and risk management platform powered by AI and tailored for adaptability. It tracks over 600 distinct fraud patterns, from payment fraud and account takeovers to synthetics, credential stuffing, money mule schemes, insider threats, and more, across industries, channels, and payment types.

FraudNet applies custom machine learning models, anomaly detection, and graph analytics (like Graph Neural Networks) to analyze every interaction and surface high-fidelity risk scores in milliseconds. It marries ML insights with a no-code rules engine and transparent scoring to let teams act in sync with their risk appetite.

These capabilities are backed by FraudNet’s Global Anti-Fraud Network, a cross-industry intelligence mesh that feeds insights and threat signals into the decisioning process. A unified data hub and orchestration layer enables seamless transactions, automated investigations, dashboarding, and consistent reporting across fraud, onboarding, and compliance workflows.

Key features:

-

- Detects and prevents 600+ fraud schemes (synthetic identity, ATO, chargeback abuse, application fraud, etc.) across industries and channels

-

- Provides real-time, AI-powered transaction and entity monitoring as part of a unified enterprise risk management platform

-

- Uses AI and machine learning together with a no-code rules engine for smart, transparent risk scoring

-

- Feeds off a Global Anti‑Fraud Network, drawing shared insights across organizations to spot emerging threats faster

-

- Includes a Data Hub for seamless integration, ingestion, and orchestration of data from across the fraud lifecycle

Hawk:AI

Hawk AI’s Transaction Fraud system is designed to evaluate transactions in real time, with average decision times around 150 milliseconds. This allows organizations to assess and act on payment risk before settlement. The platform supports multiple payment methods, including cards, ACH, checks, and real-time payment rails.

The fraud detection software combines rules-based logic with AI models, providing both out-of-the-box typology coverage and tools for custom rule development. A self-service console allows fraud teams to configure, adjust, and test rules directly, without requiring vendor intervention.

Detection models are built to identify common fraud scenarios such as ATO, merchant fraud, and money mule activity. Hawk AI also emphasizes explainability, offering context for each alert so analysts can understand the reasoning behind flagged activity.

Key features:

-

- Detects fraud typologies including ATO, mule activity, APP scams, and merchant fraud across all payment rails

-

- Delivers real-time transaction monitoring with average decision times of approximately 150 milliseconds

-

- Provides prebuilt “Day One Defense” models for rapid deployment and typology-specific coverage

-

- Includes a self-service console to configure, test, and refine rules without vendor intervention

-

- Uses explainable AI to give clear context behind alerts, improving investigation speed and accuracy

IBM Safer Payments

IBM Safer Payments is a real-time payment fraud prevention platform used by banks, processors, and payment providers. It processes thousands of payments per second, with 99.999% uptime to ensure continuity in critical payment systems.

The platform supports a wide range of modeling techniques, including decision trees, regressions, neural networks, and ensemble models. Models can be created within the system, imported using formats like Predictive Model Markup Language (PMML) or Python, or combined into ensembles. Organizations can test, validate, and deploy models directly, without relying solely on external vendors.

Fraud detection is based on profiling both senders and recipients within transactions, alongside behavioral analysis. This helps identify activity such as money mule networks, smurfing, or account misuse. Safer Payments is channel-agnostic, covering card transactions, online banking, mobile payments, and real-time payment rails.

Key features:

-

- Processes thousands of transactions per second with 99.999% uptime, supporting high-volume, real-time payment environments

-

- Operates on an in-memory NoSQL database, optimized for speed, resilience, and continuous availability

-

- Allows institutions to import external models (via PMML or Python) or build and test models directly within the platform

-

- Profiles both senders and recipients in each transaction to identify patterns such as mule activity, smurfing, and account misuse

-

- Provides channel-agnostic coverage, including cards, online banking, mobile, and real-time payment systems

-

- Uses a schema-free configuration so new data sources and attributes can be added quickly without structural changes

NICE Actimize

NICE Actimize is an integrated fraud management platform (IFM/IFM-X) that delivers real-time fraud detection, investigation, and fraud prevention across web, mobile, payments, and other channels. It applies pervasive AI, enabling organizations to detect fraud fast, minimize losses, and maintain compliance across the customer journey.

The platform leverages a typology-centric, multi-model architecture, which evaluates transactions through multiple fraud lenses simultaneously (such as scams, ATO, and mule activity) to provide unified risk scoring and typology-level visibility. This approach minimizes false positives and sharpens response precision.

NICE Actimize offers AI-powered workflows, including a Fraud Investigations solution, which uses generative and assistive AI to automate alert triage, case summarization, regulatory SAR filing, and automated reimbursement workflows. Additionally, it provides specialized modules for areas like check fraud, employee fraud, and mule ring detection.

Key features:

-

- Consolidates fraud management into a single platform with IFM-X, unifying data ingestion, detection, and investigations in real time

-

- Ingests structured and unstructured data instantly through a schema-less architecture to scale across channels and deployment models

-

- Applies typology-centric, multi-model detection to score transactions against scams, ATOs, mule activity, and other fraud types simultaneously

-

- Leverages collective intelligence from industry peers, enriched by thousands of curated risk features and explainable AI models

-

- Automates investigations with AI-powered workflows for alert triage, case summarization, SAR filing, and reimbursement processing

-

- Equips fraud teams with real-time dashboards, entity risk profiles, and visualization tools that link detection with resolution from end-to-end

SAS® Fraud Management

SAS® Fraud Management provides an end-to-end platform for detecting and preventing fraud across payments, non-monetary transactions, and enterprise events. It uses in-memory processing to score every transaction instantly, even in high-volume environments, so suspicious activity can be flagged before losses occur.

The fraud detection software system integrates advanced analytics, including machine learning models and neural networks, alongside signature-based behavioral analysis. These models adapt continuously as customer behaviors shift, helping organizations detect anomalies without relying solely on static rules. The platform consolidates internal, external, and third-party data sources to generate more accurate predictions while maintaining scalability across multiple business lines.

SAS® Fraud Management also streamlines how alerts are handled. Its rules authoring studio allows fraud teams to define, test, and deploy rules, while supporting alert triage, case investigation, and resolution from the same interface. This centralization reduces complexity and accelerates decision-making, giving analysts a clearer view of threats in progress.

Key features:

-

- Scores 100% of transactions and events in real time, delivering decisions in milliseconds, even at enterprise scale

-

- Uses adaptive machine learning and neural networks alongside signature-based analytics to detect new and evolving fraud patterns

-

- Runs champion–challenger models in parallel, enabling continuous testing and refinement without interrupting live operations

-

- Ingests structured and unstructured data from internal, external, and third-party sources with flexible, schema-free integration

-

- Profiles customer behavior dynamically with peer-group and multi-entity analysis to uncover subtle anomalies and hidden relationships

-

- Provides a rules authoring studio where teams can build, test, and deploy fraud rules with full transparency and auditability

-

- Streamlines investigations through integrated alert triage, case workflows, and downstream fulfillment within one interface

SEON

SEON builds profiles using over 900 first-party data signals, such as email, phone number, IP, and device data, to enrich user context before a transaction ever starts. This digital footprinting helps organizations spot fake identities and multi-accounting early in the onboarding process.

It layers in device intelligence, evaluating thousands of live attributes, from hardware setup and OS to nuanced behavioral signals like battery level or font count. This helps flag spoofed devices and sophisticated fraud tools.

SEON fraud detection software combines transparent AI (whitebox) and adaptive models, allowing fraud teams to see why a risk score was triggered and to fine‑tune rules. The system suggests new rule logic based on past patterns while keeping investigation workflows visible.

The platform also includes machine learning that learns from historical data, pointing out anomalies that traditional rules might miss. That intelligence spans onboarding, login monitoring, transactions, chargeback workflows, and AML checks.

Key features:

-

- Builds digital footprints from over 900 data points, enriching user profiles with email, phone, IP, and social signals to expose fake or synthetic identities

-

- Applies device intelligence by analyzing thousands of attributes (hardware, OS, browser setup, behavioral markers) to detect spoofed or emulated devices

-

- Provides transparent AI scoring with explainable outputs, showing fraud teams why a decision was made and how to adjust rules accordingly

-

- Suggests rule optimization automatically, generating new logic from past fraud patterns while allowing manual fine-tuning

-

- Operates in real time through an API-first design, enabling quick deployment and frictionless integration with existing systems

-

- Includes 240+ prebuilt rules to accelerate setup, with full support for creating and testing custom rules

Sift

Sift is built on a global data engine powered by over a trillion annual events from more than 34,000 integrated apps and sites and tracking more than 1.6 billion unique digital identities. This scale forms the backbone of its real-time fraud scoring and decisioning.

Sift has an extensive feature library, with more than 10,000 engineered signals spanning behavioral patterns, device fingerprints, and transaction activity. These signals feed into ensemble machine learning models that combine global network intelligence, industry-specific patterns, and company-level data to produce a single, high-accuracy risk score.

Scores range from 0 to 100 and can be tuned by fraud type (payment fraud, content abuse, promotions misuse, account takeover, or account origination). Each event gets real-time scoring, baked into workflows that trigger everything from manual review to blocking or frictionless approval.

Key features:

-

- Processes over 1 trillion annual events from a global network spanning 34,000+ apps and sites to power real-time fraud detection software capabilities

-

- Recognizes more than 1.6 billion distinct digital identities to improve accuracy in identity-level risk scoring

-

- Leverages a global data network that models behavioral patterns, device fingerprints, and identity signals

-

- Delivers real-time risk scores using dynamic, network-wide threat intelligence

-

- Offers built-in workflow backtesting, letting teams safely test “what if” scenarios (like adding MFA or blocking actions) before pushing changes live

-

- Combines AI-powered Dynamic Friction with rules-based logic to automate workflows in a fully configurable UI

-

- Includes case management and reporting tools, with dashboards and customizable reports

-

- Clearbox Decisioning provides transparent decision outputs so teams can see which signals and logic drove each risk score

SymphonyAI

SymphonyAI’s NetReveal Payment Fraud system monitors payments across channels such as ACH, wire, and cards. Transactions are evaluated in real time, with detection and scoring carried out in milliseconds so that institutions can block or hold suspicious activity before settlement.

The fraud prevention platform combines behavioral profiling with machine learning models to identify anomalies in customer and transaction patterns. It comes with a library of predefined fraud scenarios covering issues like account takeover, scams, and mule activity. Organizations can also configure or adjust rules to reflect their own risk exposure.

To limit false positives, the system applies anomaly detection and AI scoring, aiming to reduce the volume of unnecessary alerts while maintaining fraud coverage. When alerts are generated, analysts have access to supporting details such as customer history and behavioral indicators, which can help in triage and decision-making.

NetReveal also links into SymphonyAI’s broader investigation tools, providing case management and entity resolution so teams can follow through from detection to reporting.

Key features:

-

- Detects fraud typologies including account takeover, mule networks, scams, and card fraud across ACH, wire, and card payments

-

- Delivers real-time transaction monitoring with decision times typically under 50 milliseconds

-

- Provides 45+ prebuilt fraud scenarios for rapid deployment and coverage of common typologies

-

- Supports analyst-driven configuration to create, test, and refine rules without relying solely on vendor updates

-

- Applies behavioral profiling and anomaly detection to reduce false positives while maintaining detection accuracy

-

- Presents alerts with cross-channel context and customer history to aid faster triage and investigation

-

- Integrates with SymphonyAI’s case management and entity resolution tools for end-to-end investigation workflows

TransUnion Fraud Prevention

TransUnion Fraud Prevention is designed to detect risks early across the entire customer lifecycle. It offers identity verification using behavioral, device, and digital signals, helping organizations confirm identities confidently while minimizing friction.

The fraud detection software and prevention platform supports digital risk assessment for new users, using device-based models to verify that devices align with known user behavior, a critical element in detecting synthetic identities or fraud rings. It also enables continuous authentication across channels, tracking account changes, and monitoring transactions for suspicious behavior.

TransUnion’s system includes fraud alerts that flag identity anomalies, such as synthetic identities, velocity spikes, and relational inconsistencies, in real time. These alerts leverage credit, public, and device data to enable preemptive action and support compliance with KYC standards.

Key features:

-

- Uses a blend of identity signals (email, phone number, device metadata, and public data) to establish and verify identities with high confidence

-

- Leverages device fingerprinting, device-to-account linkages, and behavioral context to detect mismatches or fraud rings

-

- Incorporates credit history, behavioral device signals, and identity modeling to distinguish between synthetic identities, first-party fraud, and genuine users before accounts are created

-

- Generates alerts tied to identity anomalies, such as velocity spikes or relational inconsistencies, using a logic framework that flags fraud in-progress

-

- Consolidates credit, public records, device, and browsing data into a single identity graph

-

- Offers modular fraud tools, including identity insights, device intelligence, and fraud analytics, accessible and combinable through a single API framework

Unit21

Unit21 fraud detection software provides real-time prevention by allowing organizations to evaluate transactions in sub-second timeframes. The system can operate in both real-time and batch modes, supporting immediate interventions as well as bulk analysis depending on the organization’s workflow requirements.

The platform is designed to ingest a wide variety of data, including transaction details, device signals, user behavior, and external data sources. This flexibility allows organizations to build detection models that reflect their own risk exposure. Out-of-the-box rule packs cover common typologies such as ATO, ACH fraud, scams, and credential stuffing, while users can create and test their own custom rules.

Unit21 emphasizes rule testing and validation. Rules can be run in shadow mode or backtested against historical data before being deployed, helping teams reduce false positives. Alerts are presented with supporting context in dashboards that provide visibility into customer activity and flagged behavior.

Key features:

-

- Detects fraud typologies including ATO, ACH fraud, credential stuffing, and scam activity across real-time and batch payments

-

- Delivers sub-second transaction monitoring to block or flag activity before settlement

-

- Provides prebuilt rule packs for common fraud scenarios, with flexibility to create and refine custom rules

-

- Supports rule testing and backtesting in shadow mode to validate performance before deployment

-

- Ingests diverse data sources (transaction, device, identity, and behavioral signals) for broader risk coverage

-

- Integrates with device intelligence providers like Fingerprint to add signals such as bot detection, VPN/proxy use, and behavioral session analysis

-

- Presents alerts with full context in visual dashboards to support faster investigations and decision-making

Verafin

Verafin fraud detection software provides fraud prevention through a consortium-based analytics model that uses anonymized data from thousands of financial institutions. This shared data approach allows the platform to analyze patterns across both originating and receiving parties, offering broader visibility than a single institution’s dataset.

The system covers multiple payment and account types, including ACH, wires, checks, loans, cards, online banking, and real-time payments. Fraud scenarios such as account takeover and business email compromise can be monitored within one platform, with risk scoring based on customer behavior and peer activity in the network.

Alerts are generated using adaptive scoring, which adjusts dynamically as more information becomes available. The platform also includes case management tools for investigators, allowing alerts, customer profiles, and supporting evidence to be reviewed in one place. These tools connect into Bank Secrecy Act (BSA) and AML workflows, including support for suspicious activity reporting.

Key features:

-

- Detects fraud across ACH, wires, checks, cards, loans, online banking, and real-time payments

-

- Leverages consortium analytics from thousands of financial institutions for broader risk visibility

-

- Monitors both originating and receiving parties to identify anomalies across transactions

-

- Generates adaptive risk alerts that adjust dynamically as new activity unfolds

-

- Provides case management tools to review alerts, evidence, and customer profiles in one interface

-

- Integrates with BSA/AML workflows, including support for suspicious activity report (SAR) filing

-

- Incorporates check image analysis and payee profiling to improve detection in faster payment channels

Final thoughts

Fraud prevention today spans a wide range of fraud detection software and tools. Some are built to monitor payments in real time, while others are designed to stop account takeover, synthetic identity creation, or automated bot abuse.

Each has strengths in specific areas, but the underlying challenge remains the same: fraudsters are constantly evolving, and, in many cases, outpacing organizations’ ability to adapt and react quickly. That’s why it’s crucial to have a layer of intelligence and context on top of the existing detection and prevention infrastructure.

With Horizon® Identity, you can take a single identifier (e.g., an email, phone number, or username) and expand it into a full profile built from breach records, social activity, and linked aliases. With SocialNet, you can run deeper link analysis across hundreds of social and online platforms, mapping hidden connections that reveal organized fraud networks, or switch to real-time monitoring with Horizon® Monitor, which continuously tracks signals, alerting you to new activity as it emerges. This workflow moves beyond static data, providing context, behavioral patterns, and proactive alerts on fraudulent behavior.

Horizon® Identity works alongside payment monitoring, anomaly detection, or KYC tools by filling a critical gap: the external intelligence needed to connect the dots across systems and transactions. Fraud teams are empowered with exportable profiles and timelines that can accelerate investigations and triage, dramatically reduce false positives, and quickly provide vital context to otherwise ambiguous alerts.

Contact us for a demo today to learn how ShadowDragon can help your organization advance its fraud detection capabilities.

Nico Dekens

Nico Dekens